Pasinex Announces 2024 Annual and 2025, Q1 Financial Results

TORONTO, July 02, 2025 (GLOBE NEWSWIRE) -- Pasinex Resources Limited (CSE: PSE) (FSE: PNX) ("Pasinex" or the "Company") today announced financial results for the year ended December 31, 2024, and the first quarter ended March 31, 2025. The financial statements, management's discussion and analysis (MD&A), and related certifications are available on SEDAR+.

The Company also announced that effective June 27, 2025, its principal regulator, the British Columbia Securities Commission ("BCSC"), has revoked its failure to file cease trade order (the "FFCTO") that was issued on May 8, 2025. The FFCTO was issued as a result of the Company's delay in filing its audited annual consolidated financial statements for the year ended December 31, 2024, the related management's discussion and analysis of financial condition and results of operations and CEO and CFO certificates relating to the audited annual financial statements as required by National Instrument 52-109 - Certification of Disclosure in Issuers' Annual and Interim Filings (collectively, the "Required Documents") beyond the April 30, 2025 filing deadline.

The Company has filed the required documents on SEDAR+ and trading will resume on the Canadian Securities Exchange following the dissemination of this news release.

Annual Financial Results

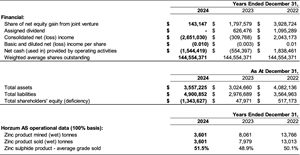

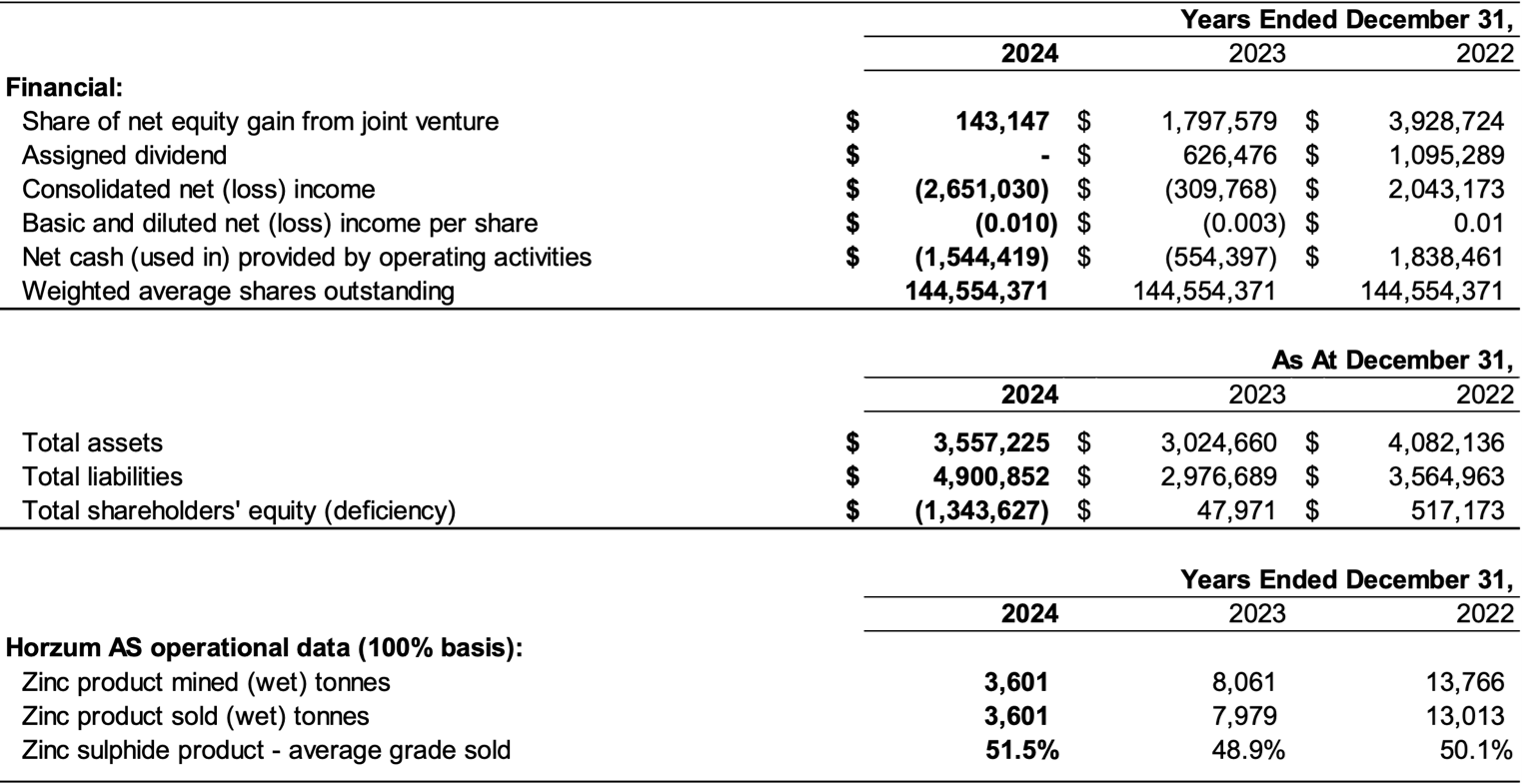

Highlights – Year Ended December 31, 2024

- In 2024, Pasinex recorded a net loss of approximately $2.7 million compared with a net loss of approximately $0.3 million in 2023. The increased loss primarily reflects lower equity gains from the Horzum AS joint venture, no dividends assigned in 2024, and higher costs incurred.

- Horzum AS produced 3,601 tonnes of high-grade zinc product in 2024, compared to 8,061 tonnes in 2023, primarily due to decreased mineral reserves and paused exploration activities resulting from ongoing legal disputes.

- Sales volumes decreased approximately 55% year-over-year to 3,601 tonnes, reflecting lower production levels. Despite lower volume, average sales prices per tonne on a USD basis increased approximately 20% compared to 2023.

- Cost per tonne mined increased significantly to CAD $985 in 2024, from CAD $601 in 2023, primarily driven by lower tonnes mined resulting in higher relative fixed and step-variable costs per tonne.

- The USD cash cost per pound of zinc product mined increased to US$0.66 per pound in 2024, up from US$0.44 in 2023, primarily due to lower production volumes, resulting in higher fixed and step-variable costs per pound.

- The average zinc grade of sold product improved to 51.5% in 2024 from 48.9% in 2023.

- Operations in Türkiye remain under significant inflationary pressures, with three-years cumulative inflation reaching approximately 291% as of December 31, 2024, impacting overall cost structures.

- Exploration activities at Pinargozu were significantly reduced due to ongoing legal disputes, with drilling activities decreasing to 6,526 meters from 10,782 meters in 2023.

- Horzum AS achieved another zero-fatality year at the Pinargozu Mine, logging 99,752 fatality-free hours and reporting reductions in both serious and lost-time injuries compared to 2023.

- Pasinex proactively secured the appointment of an Interim Committee by Turkish courts to manage joint venture operations amid ongoing disputes.

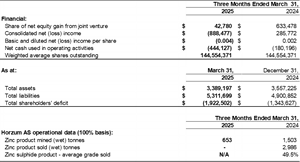

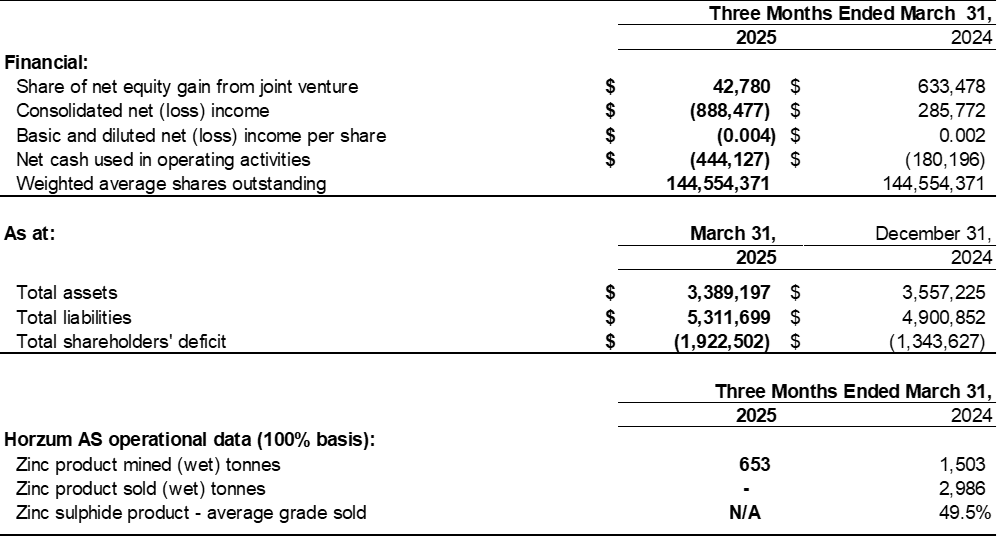

Highlights – First Quarter Ended March 31, 2025

- Net loss of approximately $0.9 million, compared to net income of approximately $0.3 million in the same quarter of 2024. The primary driver of the loss was decreased equity gains from Horzum AS, higher legal and administration costs, and losses due to hyperinflationary impacts in Türkiye.

- Horzum AS mined 653 tonnes of zinc product, a significant decline from 1,503 tonnes in the same quarter last year due to halted underground development by the JV partner, limiting ore extraction capabilities.

- No zinc sales occurred during Q1 2025 as ore was stockpiled, contrasting with 2,986 tonnes sold in Q1 2024.

- Continued legal actions aimed at resolving outstanding receivables of approximately $37.7 million owed by Akmetal.

- Subsequent to March 31, 2025, Pasinex Canada received $350,000 from related party shareholders of the Company, which have been added to existing shareholder loan agreements.

- Effective April 4, 2025, the Company granted an aggregate of 400,000 stock options to directors, officers, key employees and consultants. The options vested immediately, are exercisable at $0.05 per share and expire five years from the date of grant.

Sarikaya License Update

Pasinex continues to progress the Sarikaya License, under an agreement with Turkish company Aydin Teknik, Pasinex has until October 18, 2025, to exercise its option to acquire 100% of this high-potential zinc property.

During recent development work, a promising new ore face was discovered approximately 300 meters southwest of the existing production adit. This newly uncovered zone contains mixed carbonate and sulphide zinc ores, with initial X-ray fluorescence (XRF) measurements indicating zinc concentrations of around 30%. This discovery confirms mineralization continuity along a 500-meter trend between the historic open pit and the current production location. To facilitate extraction of this new ore, a 300-meter extension from the existing production adit is underway.

Corporate Update

Pasinex is in discussions with key investors for a pure equity private placement. The funds will be used to purchase the Sarikaya property, exploration activities, working capital purposes, and other high-grade zinc projects.

Legal Actions

Pasinex Arama, on behalf of Horzum AS, continued pursuing legal actions initiated in the second half of 2024 aimed at resolving outstanding receivables of approximately $37.7 million owed by Akmetal.

Strategic Developments

- On October 21, 2024, Pasinex announced that Pasinex Arama entered into an Option and Purchase Agreement with the Turkish company Aydin Teknik, providing an option to acquire 100% of the Sarikaya License, a Group IV lead-zinc operating license located in the Kayseri province of Türkiye.

- In early 2025, Pasinex announced a corporate update highlighting significant leadership changes.

- Ian D. Atacan, CPA, CMA appointed Director, Chief Financial Officer and Corporate Secretary.

- Aydin Sen appointed General Manager of Pasinex Arama.

- Ozlem Altunal appointed Financial Manager of Pasinex Arama.

- Ian D. Atacan, CPA, CMA appointed Director, Chief Financial Officer and Corporate Secretary.

Outlook

Pasinex continues its strategic focus on acquiring and advancing high-grade zinc properties through exploration and small-scale mining operations. The Sarikaya license represents significant potential for near-term profitability and major zinc discoveries, aligning with the Company’s goal of rapid project advancement and enhancing stakeholder value.

Qualified Person

Jonathan Challis, a Fellow of the Institute of Materials, Minerals and Mining and a Chartered Engineer, is the Qualified Person (“QP”) as defined by NI 43-101 for all information in this news release, excluding information relating to the Gunman Project. Mr. Challis has reviewed the original paid sales invoices issued by the Joint Venture for shipments of zinc sulphide product referred to in this news release and has approved the scientific and technical information provided herein. Mr. Challis is a Director of the Company and Chair of the Joint Venture.

Cautionary Note

The Company has not completed a current technical report that includes a mineral resource estimate as defined by the Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council, and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators National Instrument 43-101 (NI 43-101). The Company has no intention of completing a NI 43-101 compliant technical report. The Joint Venture has not followed accepted quality assurance and quality control procedures with respect to its current drilling program and has not used an independent third-party laboratory for its assay analysis. The Joint Venture uses field handheld X-ray fluorescence analysers (“XRF”) for zinc assays and grade control in exploration and mining. In addition, assays are completed by an independent third-party laboratory for all of the Joint Venture’s sales.

About Pasinex

Pasinex Resources Limited is a growing, zinc-focused mining company based in Toronto. Through its wholly-owned subsidiary Pasinex Arama ve Madencilik Anonim Sirketi (“Pasinex Arama”), the Company owns 50% of Horzum Maden Arama ve Isletme Anonim Sirketi (“Horzum AŞ” or the “Joint Venture”). Horzum AŞ owns and operates the producing Pinargozu high-grade zinc mine in Türkiye, selling directly to zinc smelters and refiners via commodity brokers. Pasinex also holds a 51% interest in the Gunman Project, a high-grade zinc exploration project located in Nevada. Additionally, Pasinex recently secured an option to acquire a 100% interest in the Sarikaya license, a Group IV lead-zinc operating license in Kayseri province, Türkiye, representing significant potential for near-term profitability and major zinc discoveries. Led by a seasoned management team with extensive experience in mineral exploration and mine development, Pasinex’s mission is to explore and extract high-grade ore, driving growth and creating value for shareholders, employees, and local communities, while maintaining the highest standards of safety, health, and environmental responsibility.

Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

| “Ian D. Atacan” | |||

| Ian D. Atacan | Evan White | ||

| Chief Financial Officer | Manager of Corporate Communications | ||

| Phone: +1 416.562.3220 | Phone: +1 416.906.3498 | ||

| Email: ian.atacan@pasinex.com | Email: evan.white@pasinex.com |

The CSE does not accept responsibility for the adequacy or accuracy of this news release. This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or any future results expressed or implied by such forward-looking statements. All statements within, other than statements of historical fact, are to be considered forward-looking. Although Pasinex believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not a guarantee of future performance, and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, exploration results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0fa6e383-22b2-48bd-b00a-72382cd762f3

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae94e2d7-cbf2-48d2-b4ba-50f63d8ac6dd

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.